Have you ever wondered if your insurance will cover hyperbaric oxygen therapy (HBOT)? This therapy, often associated with healing and optimal health, has intrigued many. But the question of coverage invokes the tangled web of insurance, igniting curiosity and often a bit of anxiety. Let’s walk through the basics to figure out if this treatment might fit within your insurance plan.

Table of Contents

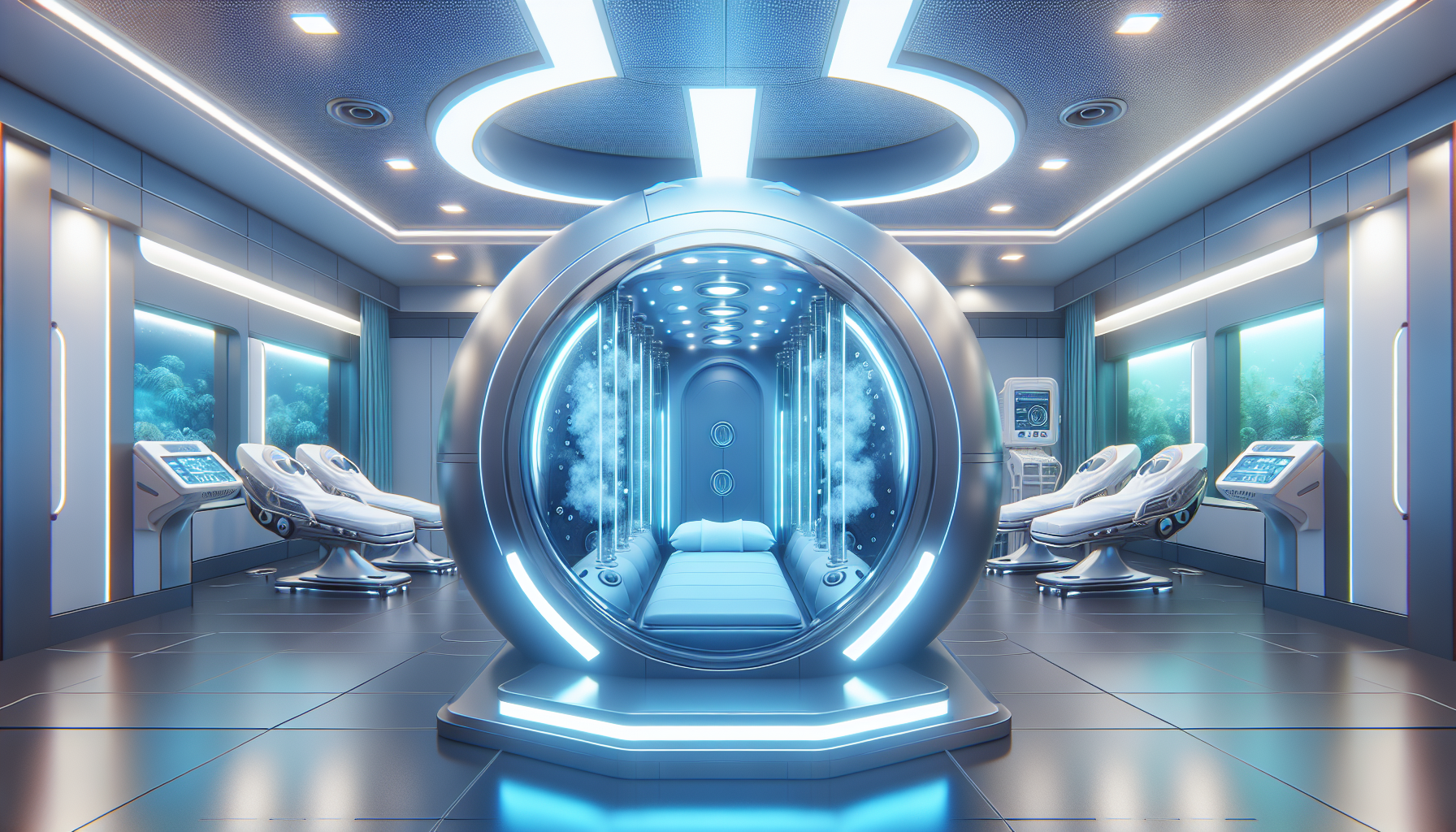

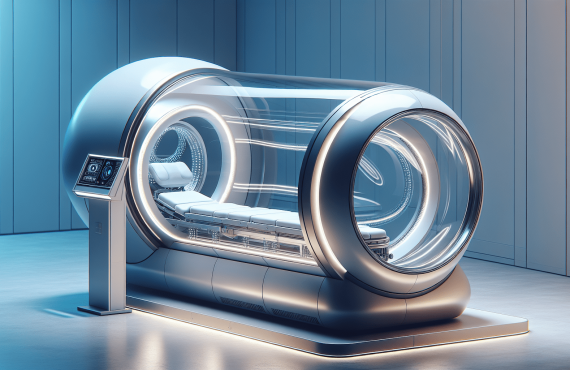

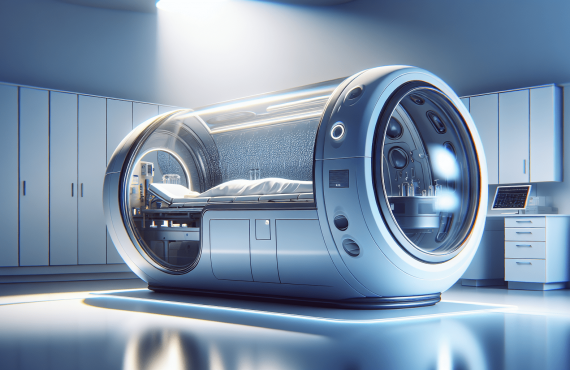

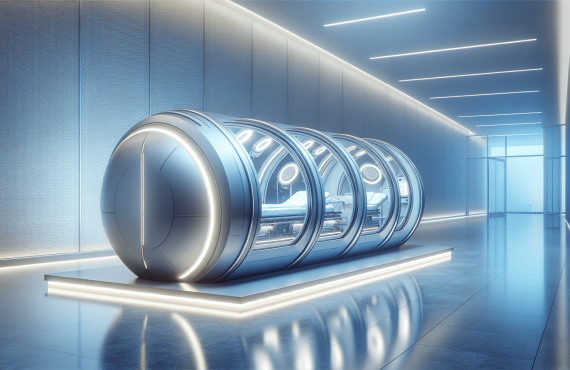

What is Hyperbaric Oxygen Therapy?

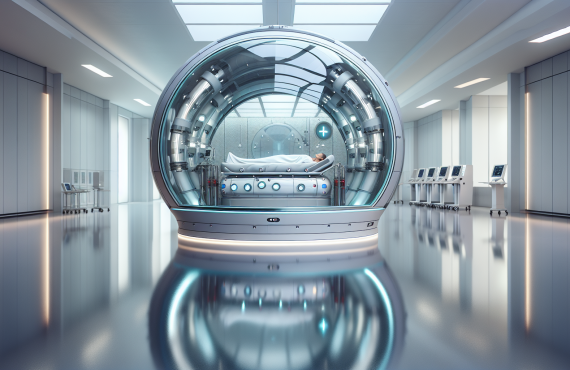

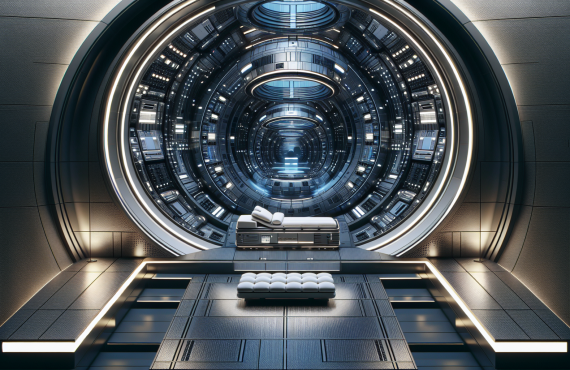

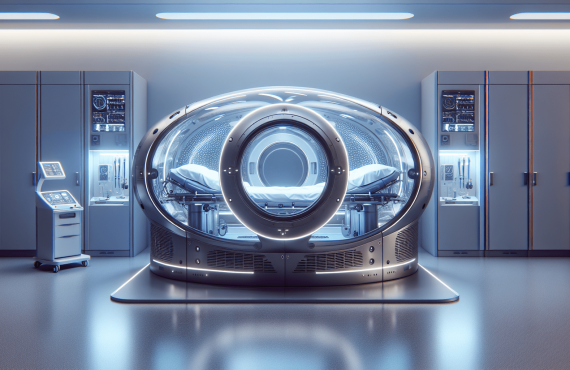

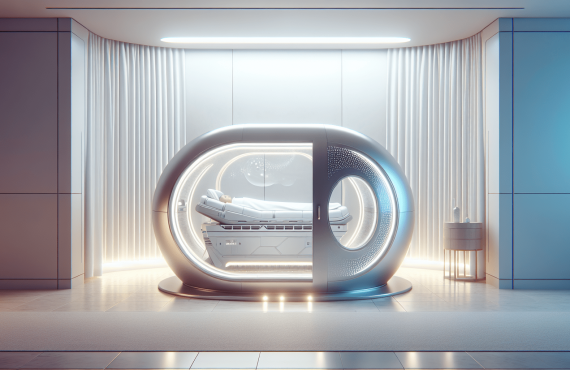

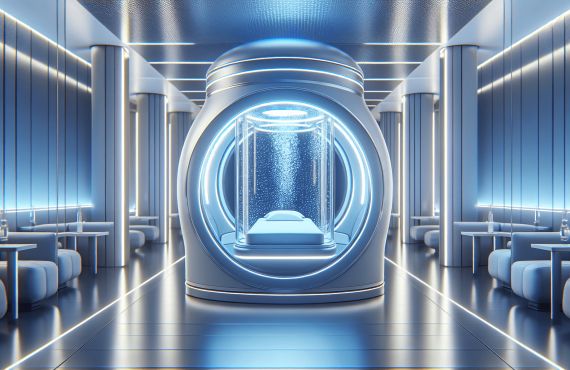

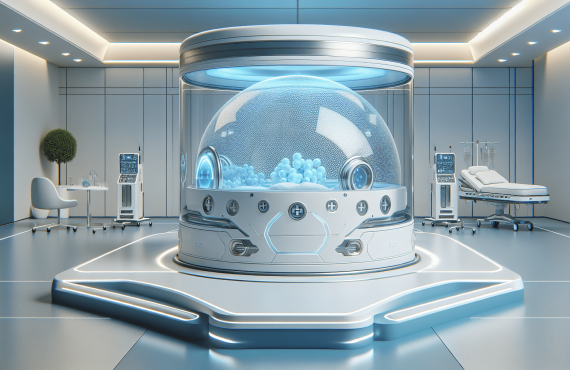

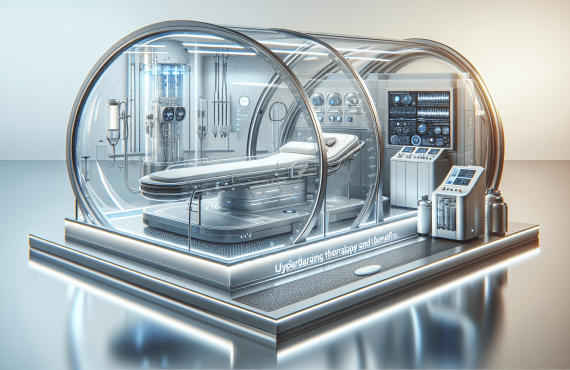

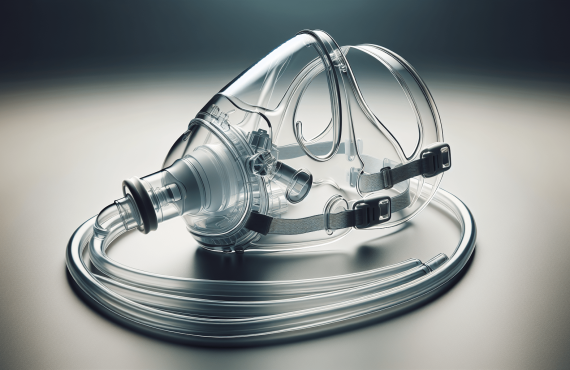

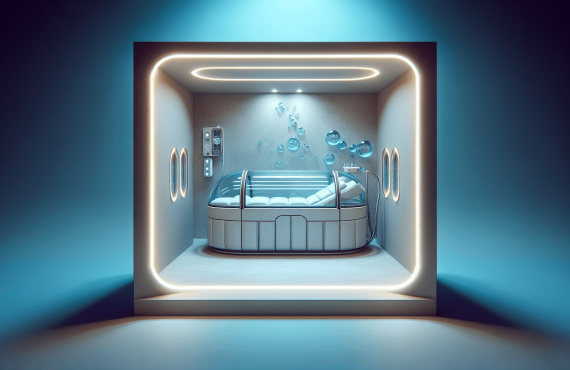

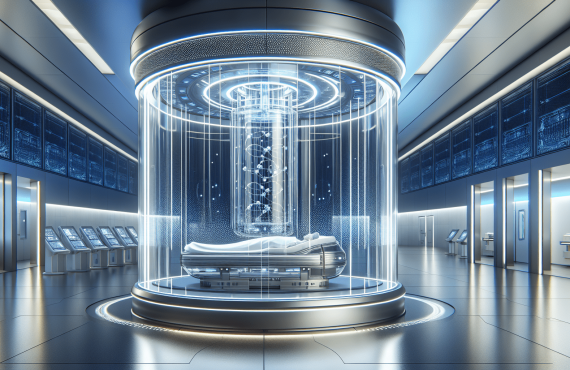

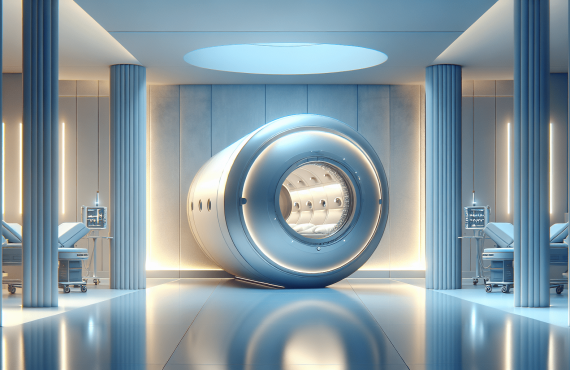

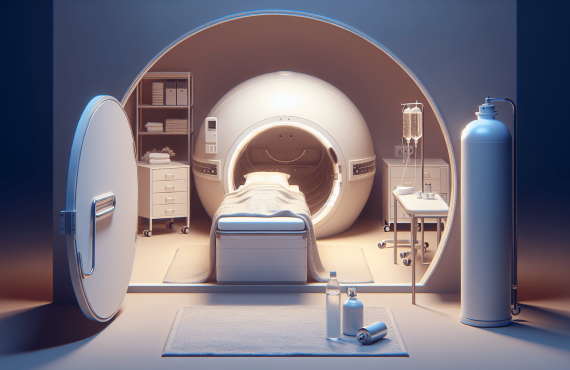

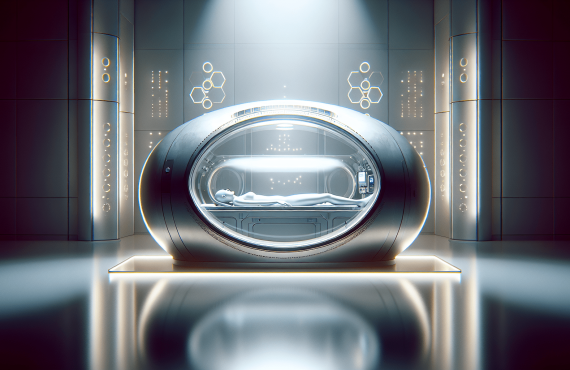

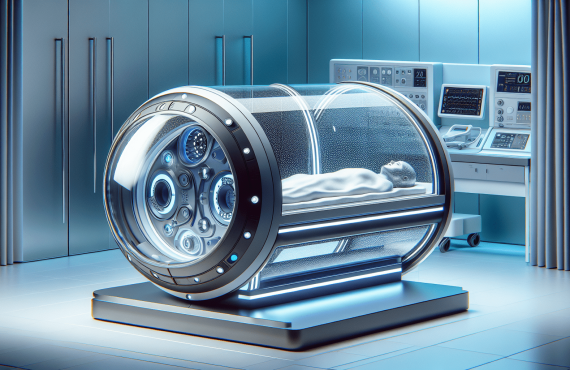

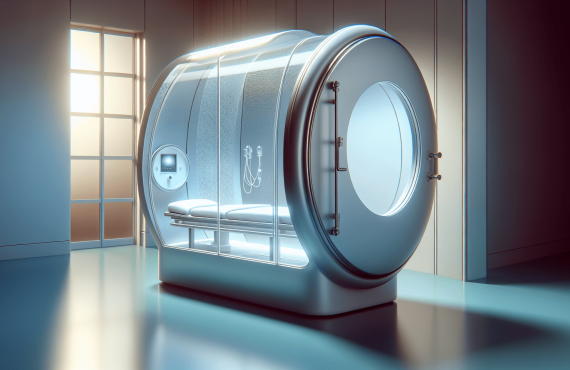

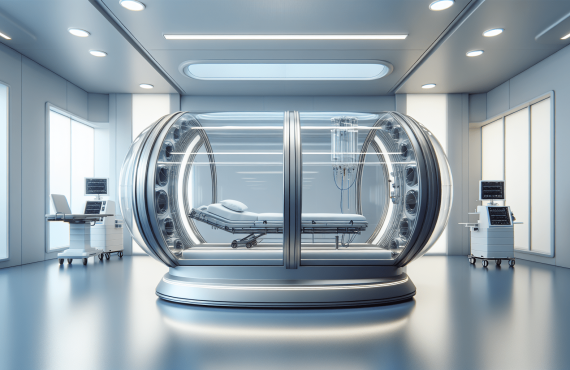

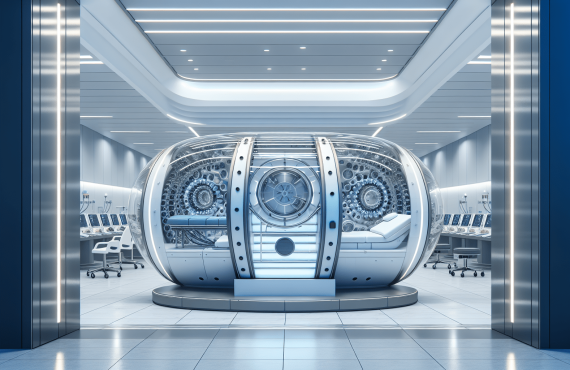

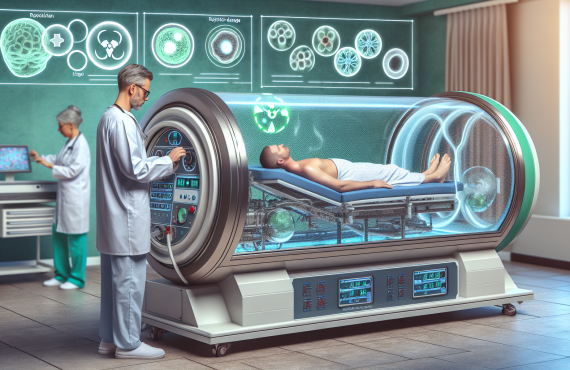

Hyperbaric Oxygen Therapy, or HBOT, is not your everyday medical treatment. Imagine entering a chamber, breathing pure oxygen, all while under greater-than-usual atmospheric pressure. This isn’t some twisted sci-fi plot but a legitimate medical treatment that leverages oxygen to promote healing and recovery.

How it Works

Stepping into a hyperbaric chamber is like stepping into your body’s own repair shop. Normally, when you’re just there on your couch inhaling and exhaling, your lungs deliver oxygen to wherever it’s needed via your bloodstream. It gets there just fine, but sometimes certain parts of our body demand more oxygen. This is where HBOT steps in, increasing oxygen levels in the blood, permeating tissues with a healing explosion. The effects? Reduced inflammation, tissue repair, and a jumpstart to your immune system. It even nudges the body to grow new blood vessels, aiding in wound healing—talk about putting on your body’s superhero cape!

Common Uses of HBOT

Primarily, HBOT is often used to treat decompression sickness, a concern for divers. But its purpose spans beyond the deep-diving folks to conditions such as:

- Carbon monoxide poisoning

- Non-healing wounds

- Severe anemia

- Crush injuries

- Infections like diabetic foot ulcers

The Big Question: Does Insurance Cover HBOT?

The answer here is much like the weather—sometimes yes, sometimes no, and sometimes, well, maybe. Coverage often rides on the specific medical necessity. Let’s unpack this a bit more.

When Insurance Provides Coverage

Insurance companies like to cover treatments that prove their worth, so to speak. If HBOT is included in the standard treatment for certain conditions, chances are you’re in luck. These conditions usually include:

- Decompression sickness

- Serious burns

- Sudden hearing loss

- Radiation tissue damage

When Insurance Doesn’t Cover HBOT

For less traditional uses or “off-label” conditions, the outlook is a tad cloudy. Treatments for these conditions often fall out of the neatly defined boundaries insurance companies love:

- Autism

- Lyme disease

- Cerebral palsy

- Stroke recovery

In these gray areas, coverage is less predictable, and approval is an uphill trek that may not always lead to success.

Navigating Your Insurance Plan

Before jumping face-first into the hype of HBOT, contact your insurance provider. Here’s how you can make that conversation count:

Steps to Take

-

Research Your Plan: Look into the specifics of your insurance plan. What does it say about treatments like HBOT? Is pre-authorization required?

-

Speak Clearly: When you contact your insurance company, have ready information about HBOT and the health condition you want it for. Be precise to avoid misinterpretations.

-

Seek Confirmation in Writing: Don’t rely solely on what you hear. Request a written confirmation or denial for your records.

Anticipated Challenges

Dealing with insurance companies offers challenges akin to walking through a charming yet tricky maze. Be ready with documentation and patience. Approval processes can be extensive and frustrating, requiring persistence and sometimes, an appeal or two.

FAQ About Hyperbaric Oxygen Therapy and Insurance

1. Can all hospitals provide hyperbaric oxygen therapy?

Not all hospitals house the specialty equipment required or have staff trained to administer HBOT. It’s provided in select facilities.

2. How many HBOT sessions are typically necessary?

Treatment plans vary. They can range from a single session to 20 or more, depending on the condition treated.

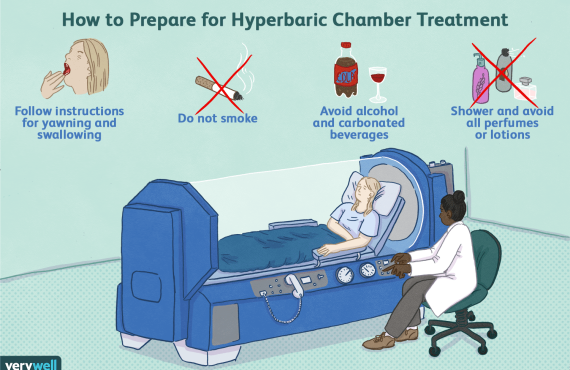

3. Is HBOT considered safe?

Yes, when conducted by trained professionals in a proper environment. Mild side effects such as ear discomfort might occur.

4. Does Medicare cover HBOT?

Medicare may cover HBOT for specific conditions; it’s crucial to confirm individual coverage.

5. What should one do if insurance denies coverage?

Consider discussing alternatives or appeals with your healthcare provider or contacting patient advocacy organizations for guidance.

Connect with Experts

Curious for more insight? Consider reaching out to a place like Henry Chiropractic. Their team, headed by Dr. Craig Henry, offers expertise in promoting health and wellness across Florida. They’re located at:

Henry Chiropractic

1823 N 9th Ave

Pensacola, FL 32503

(850) 435-7777

Visit Henry Chiropractic

Meet the Team

Dr. Craig Henry

Dr. Henry is the heart and soul of Henry Chiropractic. Not just a chiropractor, he’s a guide to feeling better in your everyday life. Whether you’re dealing with the nagging pain in your back or curious to see what chiropractic magic can do next, he’s your go-to person.

Dr. Aaron Hixon

Dr. Hixon shares his Florida roots and passion for helping people. With a science degree and chiropractic expertise, his role extends beyond adjustments. Whether it’s through volunteering or his knowledge of diverse techniques like Myofascial Release, his goal remains the same—your well-being.

In Conclusion

The quest for insurance coverage of HBOT is as much an exploration as it is a careful navigation of both medical necessity and insurance fine print. While insurance might not always have you covered in all scenarios, arming yourself with knowledge helps. Talking with professionals, like those at Henry Chiropractic, might just offer you clarity in the maze of healthcare choices. Remember, insurance companies are vigilant gatekeepers, but clear inquiry and assertive follow-up might hold the key to unlocking the benefits you need.