Have you ever wondered if your insurance will cover therapies that offer alternative solutions to traditional medical treatments? One such treatment is Hyperbaric Oxygen Therapy (HBOT), which appears mysterious yet promising for many medical conditions. But does it fit snugly within your insurance coverage like a favorite sweater, or is it more akin to that forgotten gift card buried in your wallet, its terms elusive and confusing?

Table of Contents

What is Hyperbaric Oxygen Therapy (HBOT)?

Definition

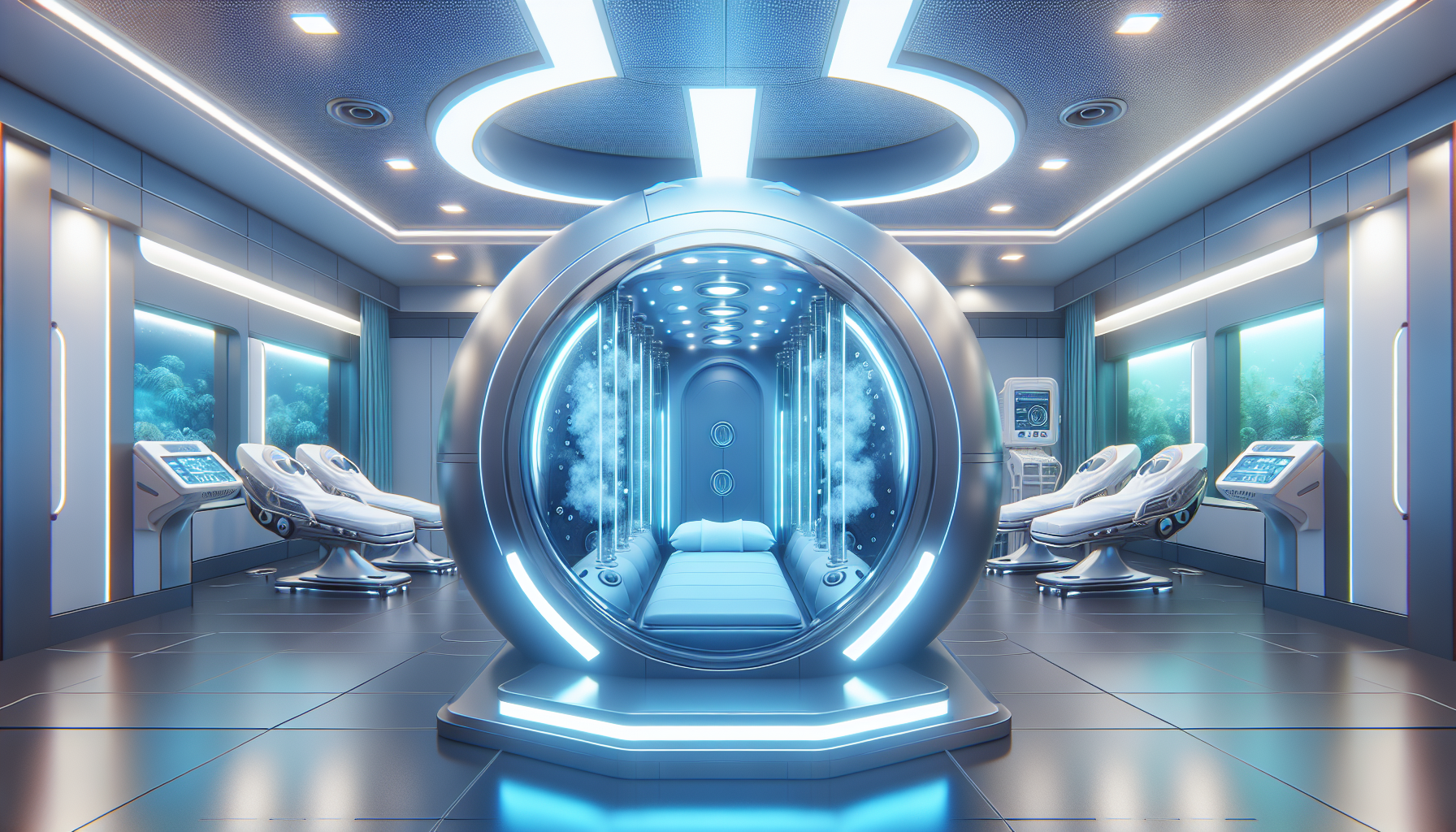

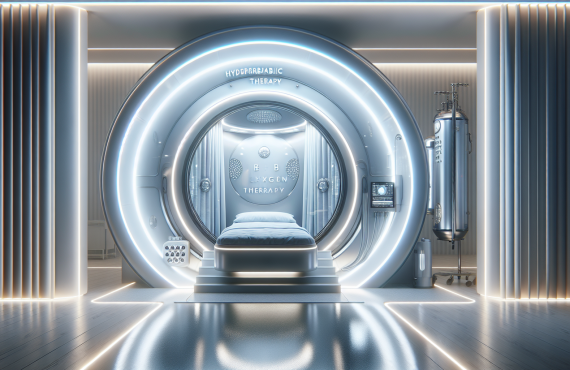

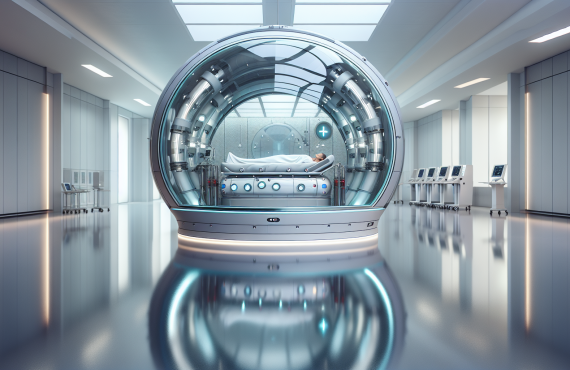

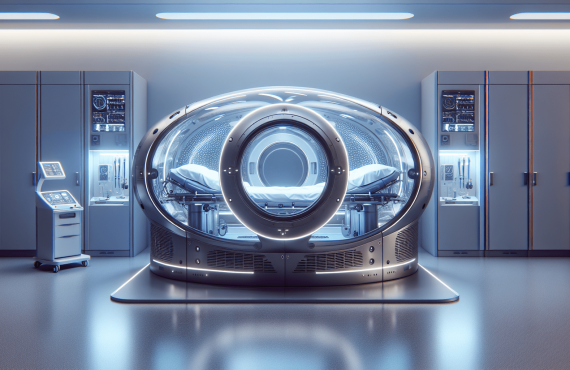

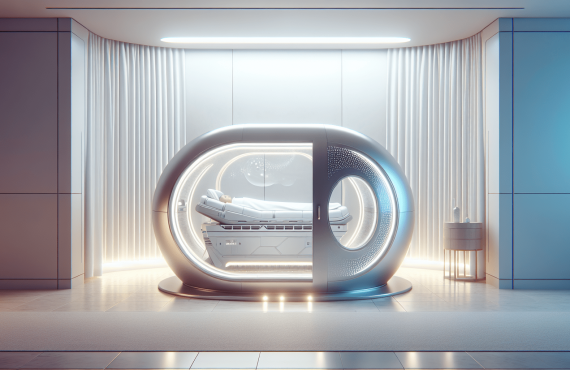

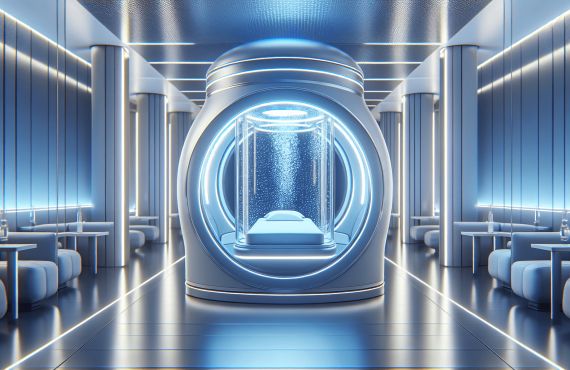

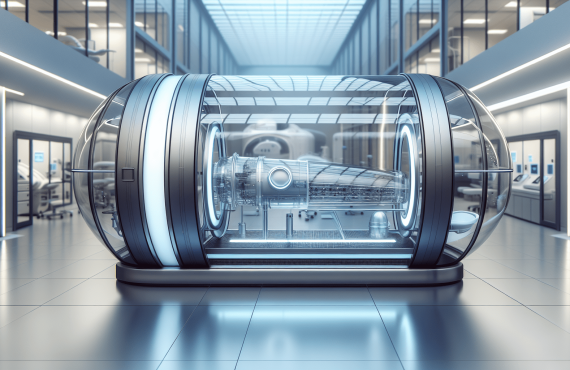

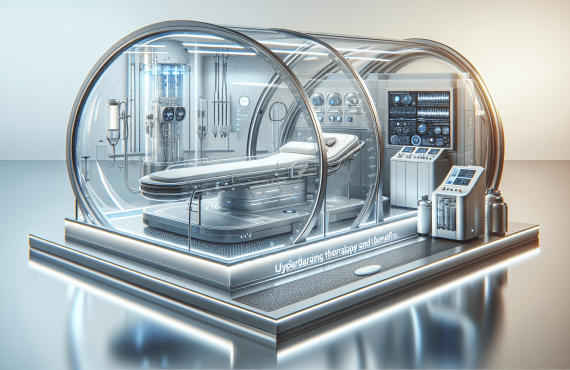

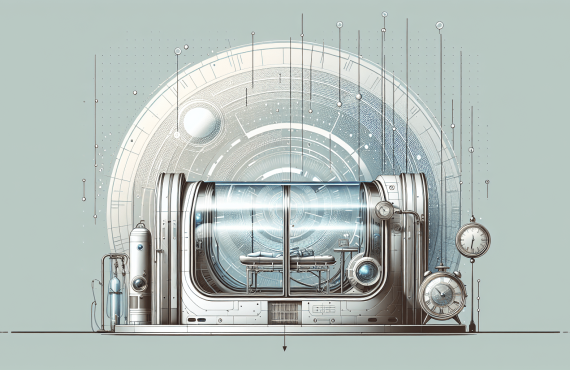

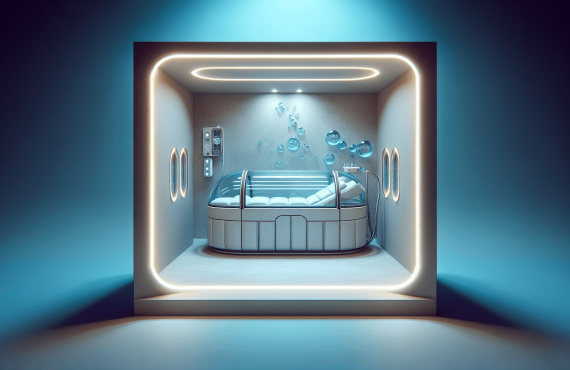

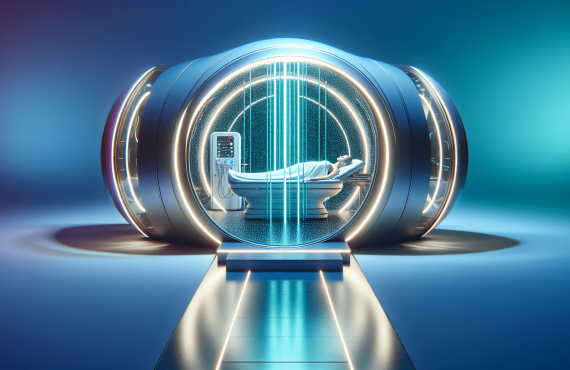

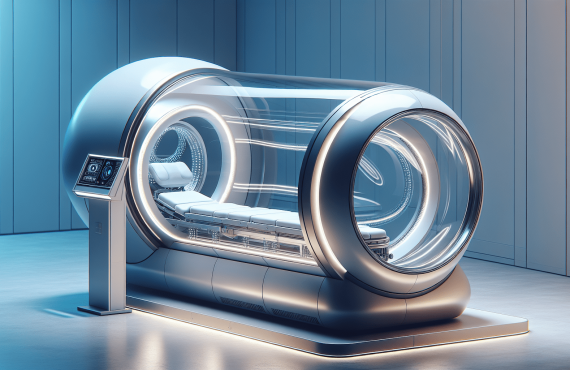

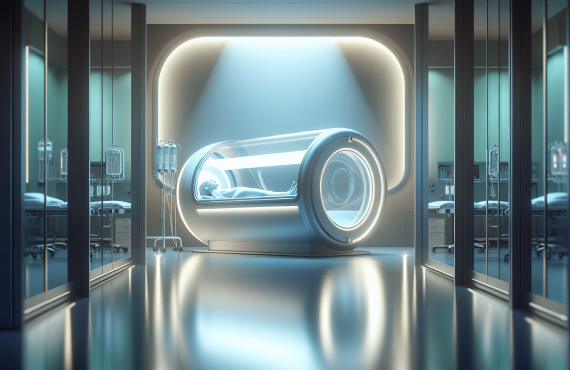

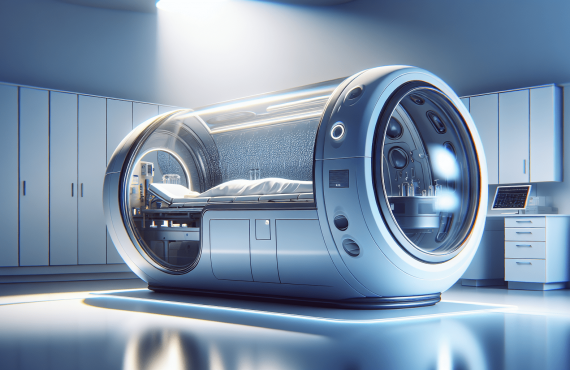

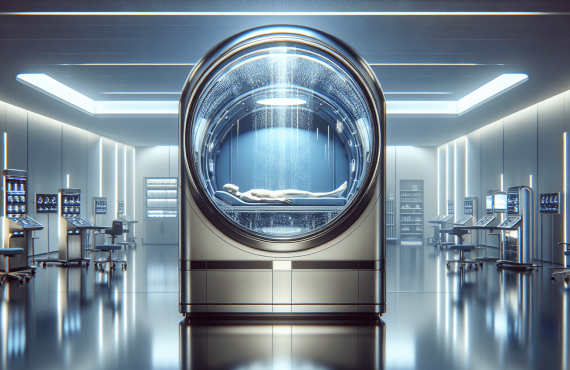

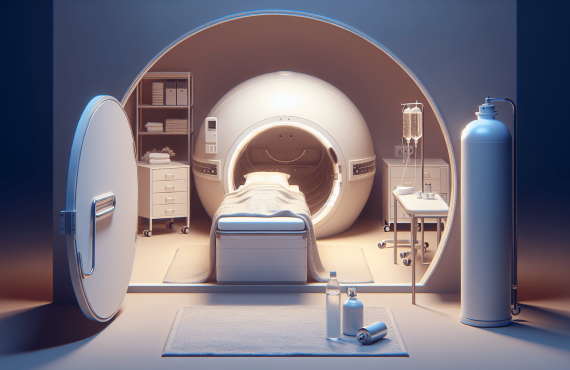

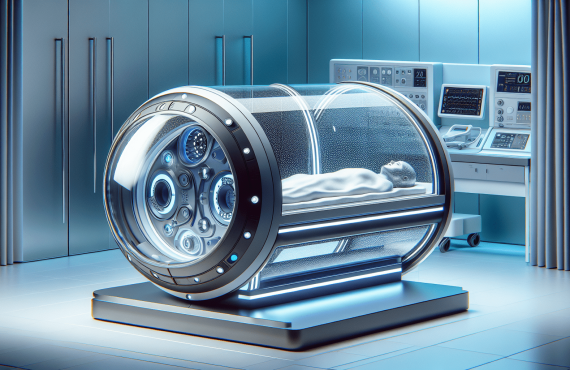

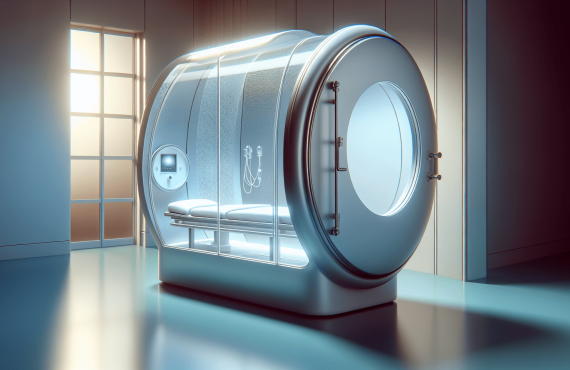

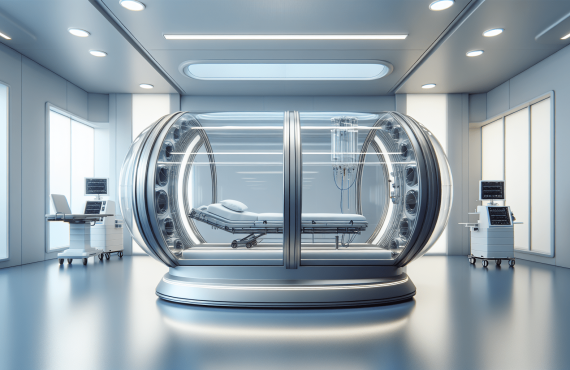

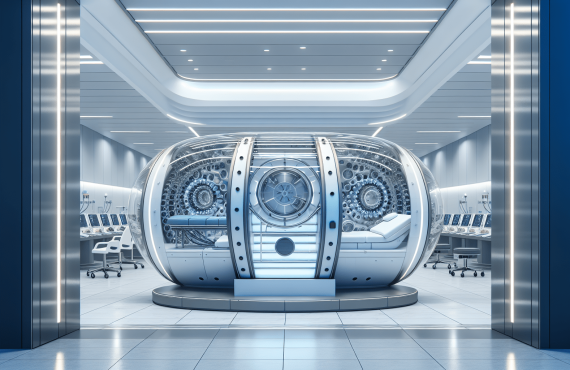

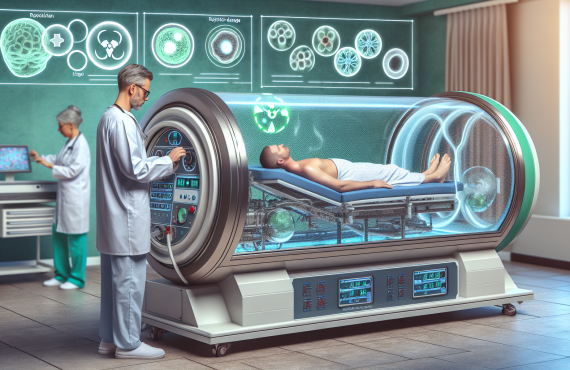

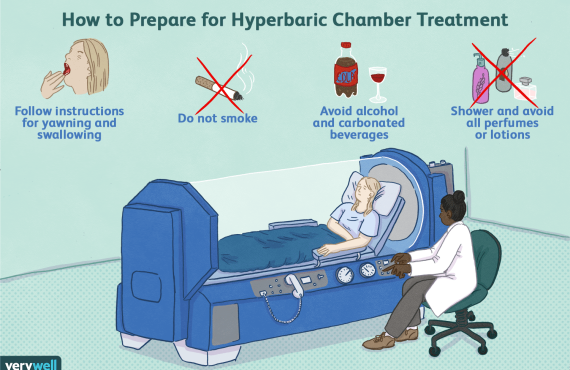

Imagine breathing in pure oxygen while nestled in a specially designed chamber that looks like part of a sci-fi film set—except you’re not auditioning for a movie role. This is Hyperbaric Oxygen Therapy, where you’re treated with 100% oxygen at pressures greater than what you’re used to daily. Imagine it as a spa day for your cells, where they soak up more oxygen than a beach towel soaks up sunshine.

How It Works

Under your everyday atmospheric conditions, your lungs do a pretty decent job of grabbing oxygen from the air and delivering it to your body’s tissues through your blood. But sometimes, decent isn’t good enough. Enter the hyperbaric chamber stage left. Inside this pressurized world, oxygen concentrations in your blood escalate faster than your coffee intake on a Monday morning. This means oxygen can now reach body areas struggling to get their fair share.

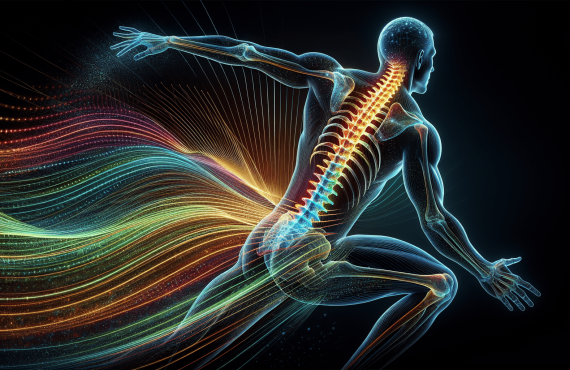

The oxygen-rich blood jumps into action, stimulating your natural healing processes, promoting tissue repair, quelling inflammation, and boosting immune function. It even encourages new blood vessels to grow—a process charmingly known as angiogenesis—which is crucial for winding up wounds and regenerating tissues.

Common Uses of HBOT

You might think, “Sure, this sounds fancy, but what is it actually used for?” HBOT is a headliner in treating conditions like carbon monoxide poisoning, decompression sickness (a.k.a. “the bends” that divers dread), and stubborn wounds—particularly those meddling with diabetic patients. Its applications extend to treating bone infections, radiation injuries, and arterial gas embolism. Some folks even explore HBOT for less conventional issues, like neurological disorders or boosting overall wellness.

The Benefits of HBOT

The perks of climbing into a hyperbaric chamber can be significant. Aside from enhancing recovery times and reducing inflammation, HBOT is championed for improving circulation and oxygen uptake in tissues. This can lead to better outcomes in healing wounds, reducing edema (that bothersome swelling you wish stayed in a swollen, far-out galaxy), and supporting the body’s natural detoxification processes.

Does Insurance Cover HBOT?

The Great Coverage Debate

Now, onto the burning question: does your trusty insurance plan cover HBOT? The answer, alas, isn’t as straightforward as a freshly paved road. Insurance coverage for HBOT largely depends on the condition treated and the specific details outlined in your insurance policy. For certain conditions such as decompression sickness or non-healing diabetic foot ulcers, insurance companies are more likely to say, “Sign me up!” and offer coverage.

Conditions Generally Covered

Insurance companies tend to cover HBOT for a set list of ‘approved’ conditions based on extensive clinical research showing its effectiveness. Generally, the following conditions frequently make the cut for coverage:

- Decompression sickness

- Chronic non-healing wounds

- Severe anemia

- Radiation injuries

- Crushing injuries

This list isn’t exhaustive, but it gives you an idea of the types of situations where insurance companies might nod approvingly at HBOT.

Conditions Typically Not Covered

Unfortunately, life isn’t all sunshine and lollipops. Some insurance plans can leave you high and dry when it comes to HBOT for conditions where evidence of benefits isn’t firmly established. These might include:

- Autism

- Lyme disease

- Stroke recovery

- Multiple sclerosis

Of course, this doesn’t mean HBOT isn’t potentially beneficial for these conditions—it simply means insurance companies might be hesitant to fork out the cash without conclusive clinical evidence.

Navigating the Insurance Waters

Understanding your insurance policy sometimes feels like trying to read War and Peace backward. When considering HBOT, it’s crucial to communicate openly with your healthcare provider and insurance company. Clarify what you want to treat with HBOT and confirm the specifics of what’s covered under your plan. Insurance policies vary widely (like the weather) and might depend on factors like region, employer, and plan specifics.

Here’s a handy table to make things clearer (or at least attempt to):

| Condition | Likely Covered by Insurance | Coverage Varies |

|---|---|---|

| Decompression Sickness | Yes | No |

| Non-Healing Wounds | Yes | No |

| Autism | No | Yes |

| Radiation Injuries | Yes | No |

| Stroke Recovery | No | Yes |

Why Insurance Coverage Matters

Financial Implications

Understanding whether your insurance will cover HBOT is like playing a strategic board game where financial stability hangs in the balance. HBOT sessions can be hefty on the pocket, and knowing upfront whether insurance will alleviate this cost can be crucial for decision-making. Uncovered sessions might require deep dives into your savings—a scenario no one wants unless it’s for an impromptu trip to a tropical paradise.

Access to Treatment

Insurance coverage can significantly impact your ability to access treatment options. With coverage, HBOT becomes a feasible treatment route, broadening your therapeutic horizons and improving your chances for recovery. Without it, you might have to cobble together funds or explore other therapies altogether, which might not be as effective or appropriate for your particular needs.

Dr. Craig Henry and Henry Chiropractic

If all this talk of insurance makes you want to flee and hide amidst the sunny beaches of Pensacola, Florida—and you find yourself in the area—you might stumble upon Henry Chiropractic. Owned by Dr. Craig Henry, the practice offers chiropractic care to help you navigate through life’s physical aches and pains.

Dr. Craig Henry

Dr. Henry is like the friendly neighbor whose warm-baked cookies are chiropractic wellness in human form. A licensed chiropractor, Dr. Henry focuses on improving health and wellness across a patient’s life. From grumbling backaches to neck strains that have you posturing like an old marionette, he’s there to help you straighten up—quite literally. His practice is rooted in providing quality care for the Pensacola community.

Dr. Aaron Hixon

Alongside Dr. Henry is Dr. Aaron Hixon, a Florida native who carries the passion for helping others with a vigor that’s palpable from a mile away. With his background in exercise science and diverse chiropractic techniques, Dr. Hixon offers a holistic approach to care. His presence at Henry Chiropractic adds a depth of expertise and a dash of enthusiasm. When he’s not busy at the practice, you’ll likely find him engaging in fitness activities or soaking up the local dining scene.

Hyperbaric Therapy at Henry Chiropractic

While primarily focused on chiropractic care, you might discover valuable insights about HBOT by contacting Dr. Henry’s practice. With their commitment to your well-being, the team at Henry Chiropractic can offer guidance on the intersection of chiropractic care and alternative therapies, like HBOT, when considering treatment plans.

If you’re in Pensacola and need professional advice, reaching out to Henry Chiropractic could be worth your while:

Henry Chiropractic

1823 N 9th Ave

Pensacola, FL 32503

(850) 435-7777

Dr. Craig Henry’s Website

FAQs About HBOT and Insurance

1. Is HBOT covered by all insurance plans?

Unfortunately, not all insurance policies are created equal. Coverage for HBOT largely depends on the condition being treated, the insurance provider, and your specific plan. It’s best to consult with your insurance company directly about your coverage.

2. What should I do if my insurance doesn’t cover HBOT?

First, speak with your healthcare provider about alternatives and the necessity of HBOT. If it’s critical to your treatment, you might consider contacting your insurer for exceptions or exploring financial aid programs that help cover the cost of medical treatments.

3. How much does a typical HBOT session cost without insurance?

The price can vary widely based on location and facility but generally ranges from $250 to $450 per session.

4. Can HBOT be used for off-label conditions?

Yes, HBOT is sometimes used for conditions not explicitly approved by insurance, like autism or Lyme disease. But it’s crucial to consult with a healthcare provider familiar with HBOT to discuss potential benefits and drawbacks.

5. How many HBOT sessions are typically required?

The number of sessions can range from 10 to 60 or more, depending on the condition being treated, the severity, and your treatment response. Your healthcare provider will tailor a treatment plan to your specific needs and progress.

In conclusion, navigating the insurance realm for HBOT can be a perplexing journey. It requires careful consultation with both healthcare providers and insurance representatives. Still, by asking the right questions and considering your treatment options, you can determine whether HBOT is the best path for you—and if it’s time to unearth that metaphorical gift card after all.